As we have all witnessed, the last 18 months have exhibited a dramatic increase in the prices collectors and investors have paid for quality coins. This phenomena is not only visible in the numismatic arena but appears across the various collectible venues.

To gain a perspective as it applies to the numismatic communities, I enclose commentary from:

- Cristiano Bierrenbach, Executive Vice President Of International Numismatics, Heritage Coin (Heritage Podcast 6/16)

- Dan Sedwick, President And Founder Daniel Frank Sedwick, LLC ( personal conversation 6/21 )

- Kent Ponterio, Principal, World Numismatics, LLC (personal conversation 7/30 )

When referencing comments from these individuals I will attribute their comments with their initials, CB, DS and KP.

We witnessed a major shift in how collectors and investors were able to acquire coins since the Covid pandemic emerged. The traditional forums of coin shows and coin stores were not available to the collector and investor. Interested collectors and buyers then moved to online venues and auctions. These individuals were not spending their financial resources at coin shows, traveling, restaurants, and entertainment.

CB – There was clearly a “pent up demand increasing during the last 18 months, much of it driven by a global drive towards alternative investments and assets. People have more time to utilize and this helped create a perfect storm.”

DS – Coupled with this scenario were “interests from Asian markets for alternative forms of investments to acquire non taxable investments and a shift in certain European communities to protect cash assets from charging interest on cash deposits.”

KP -Stated most succinctly, “stuff is going nuts.”

Why coins versus other collectibles ?

KP – ” The collector base is growing.”

CB – “Coins have been collected for centuries (vs other collectibles) and there is less volatility, less of sharp fluctuations.”

DS – Coins present ” a quiet investment, provide intrinsic value and offer a variety of forums for liquidity. Precious metals, rarity and portability are important factors.”

CB – “Another factor that has proven itself once again is that quality coins never go out of style. Great collections focus on quality. If you focus on quality there is little chance you can go wrong.”

Is the collector base growing?

KP – “Yes, the collector base is growing. Interest in more modern (lower priced) has brought out new collectors and many will convert to rarities and more historical coins with time.”

DS – The coin collector base ” is growing and there is a noticeable amount of new interest not just new collectors so much as new buyers (dealers and collectors alike) who are now having to spend more and are doing so willingly.”

KP – “A great current interest in Mexican coins are the mint issued limited editions from the past several decades and coins of the republic. Many of these are new collectors.”

What does the near term future look like?

CB – “It is currently a seller’s market. How and when the market will turn is uncertain but there are still opportunities and the market is bringing out high quality collections. How when and if the market may turn is unpredictable.”

DS – “The market may plateau short range but will not go back to the former levels.”

What is the effect of slabbing?

KP – “Slabbing has brought familiarity and a comfort zone to the buyer. There is a continuing shift for dealer/auctioneers to present all of their inventory slabbed.”

Inventory and supply? One of the most frequent comments this author hears is the difficulty of dealers to acquire new inventory during the pandemic. The traditional coin dealer relies heavily on coin shows for acquiring inventory and relies on traveling to dealers worldwide in search. Both of those forums dried up during the pandemic.

KP – “The traditional method of selling coins in Europe has been for sellers to travel by train to the large cities and sell to dealers. These people didn’t travel due to restrictions or personal fears so the supply has been drying up. As the shows are reopening many dealers are reluctant to leave their bourse tables in fear of missing needed sales.”

CB – Conversely, “the seller’s market has brought out high quality merchandise.”

What is the current position of shipwreck coins in particular in the current market? Most of this dialogue was (naturally) with Dan Sedwick as his firm specializes is shipwreck coins and artifacts.

DS – “Shipwreck coins have been expecting sharp growth for years and here it is. There are fewer resources for new finds but the market jump has more coins from old recoveries and collections being pulled into the market. The shipwreck coin market is growing with new interest from new collectors. Another factor is slabbing. Wary collectors have found a comfort zone with certified slabbed coins. Slabbing provides many answers that questionable buyers confront. As the old supply dwindles and with the shortage of new supply there has been a noticeable surge in pricing.”

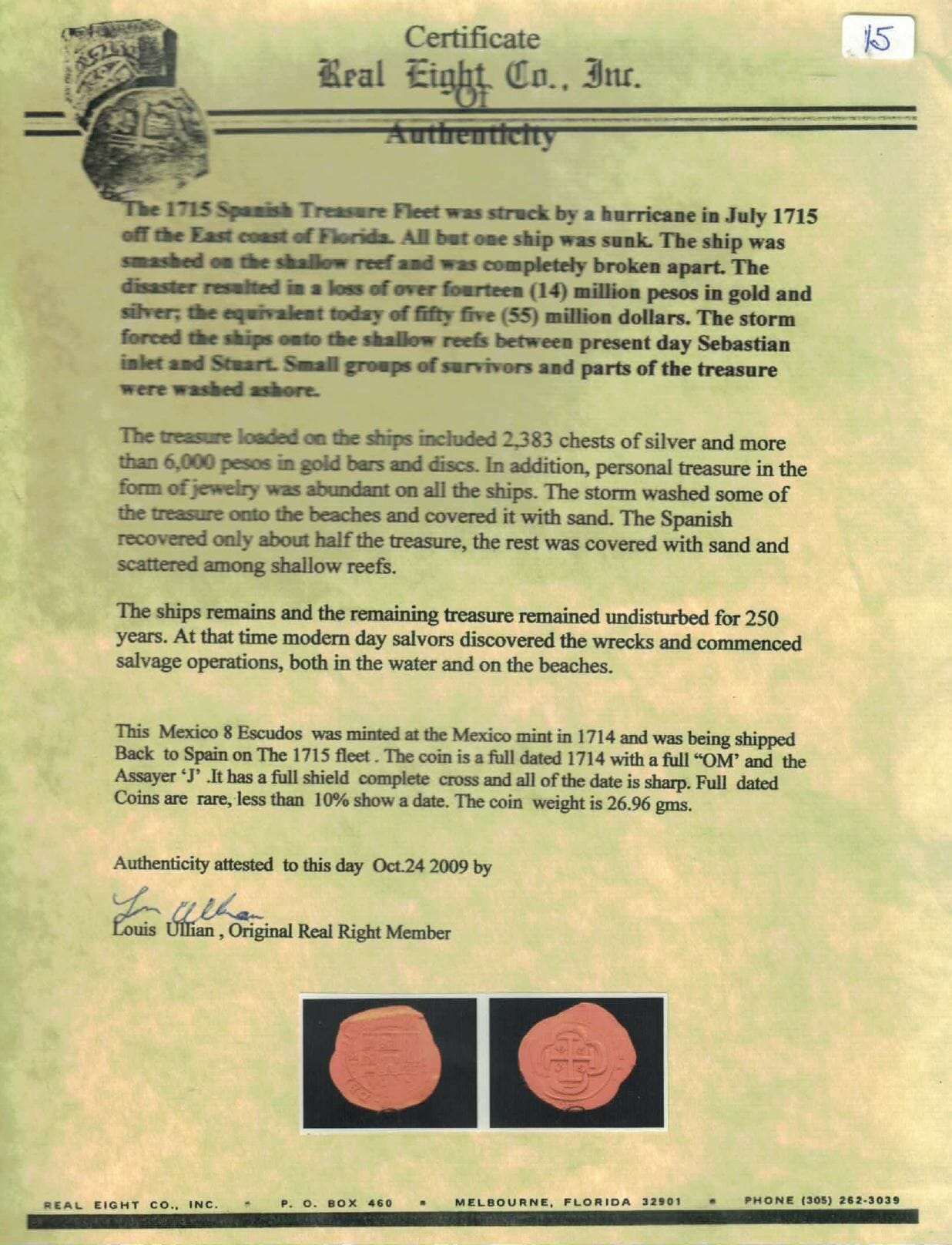

KP – “Collectors and investors are also interested in trophy coins and the gold escudos of Lima and Mexico are filling that desire, royals in particular.”

Treasure coins in jewelry have also now entered the form of art and this arena continues to grow as well. Dealers are not encouraging this practice but note that most of the jewelry coins being utilized in jewelry have trivial numismatic value. In particular, shipwreck coins with original salvors provenance and certification are exploding in value. The interest in quality gold shipwreck coins is international.

KP – “Many of the choice coins are going to Asia and I do not see those coins coming back to the US market.”

In summation, it looks like a very healthy market. If you buy quality, likely time will reward your investment .

John Pullin

Director, 1715 Fleet Society